Hyperbeat backed by Coinbase Ventures, with a recent $5.2 million oversubscribed seed round and a comprehensive Hearts points program, this could be your chance to participate in the next major airdrop. Here’s is the step by step guide to join the beHype Airdrop on HYPE chain.

What is Hyperbeat Protocol and How It Works

Hyperbeat is a native protocol built specifically for the Hyperliquid ecosystem, designed to scale HyperliquidX and HyperEVM.

Why invest in Hyperbeat Airdrop:

Validator Operations: Hyperbeat runs a validator node called ‘HyperP2PBeatio’ in collaboration with P2P.org, helping secure the Hyperliquid network while generating staking rewards.

Yield Optimization: The protocol unlocks yield from Hyperliquid’s funding rates—previously accessible only to advanced market participants—and packages it into simple, user-friendly vaults.

Liquidity Solutions: Through strategic partnerships with projects like Ethena Labs, Morpho Labs, and Mizu, Hyperbeat provides comprehensive liquidity strategies across the HyperEVM ecosystem.

How to earn Hyperbeat heart points

- beHYPE: Liquid staking token allowing users to stake HYPE while maintaining liquidity

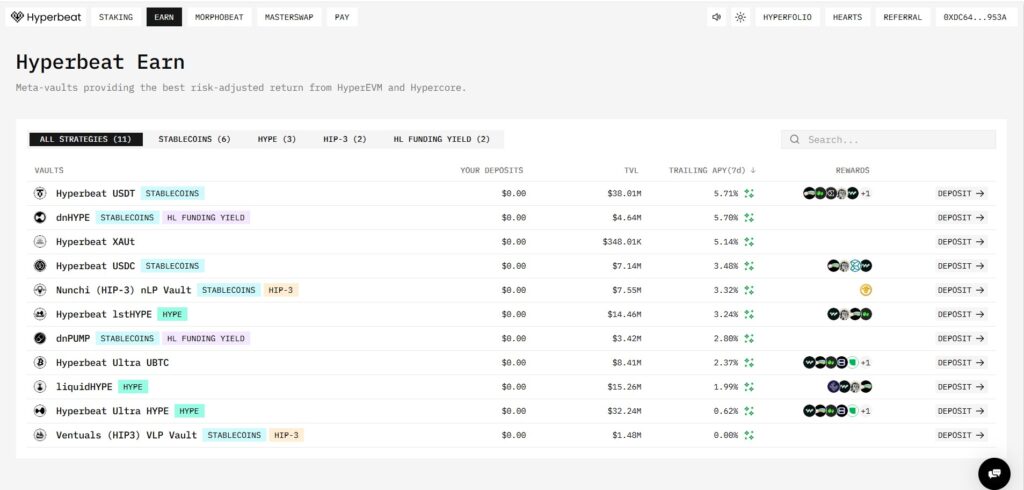

- Hyperbeat Earn: High-yield vaults on HyperEVM for automated returns

- Morphobeat: Credit layer enabling borrowing against vault positions

- Hyperbeat Pay: Protocol alternative to traditional banking rails

- Hyperfolio: Portfolio tracker integrating all ecosystem products

Hyperbeat list of Investors and Team Analysis

Tier-1 Institutional Backing

Seed Round Details (August 15, 2025):

- Amount: $5.2 million (oversubscribed)

- Lead Investors: ether.fi Ventures & Electric Capital

- Notable Participants:

- Coinbase Ventures

- Anchorage Digital

- Chapter One

- Selini Capital

- Maelstrom

- HyperCollective (community backing)

Investor Credibility Score: 9/10

The backing from established DeFi giants like ether.fi (liquid restaking leader) and Electric Capital (major crypto VC) signals strong institutional confidence.

Team Background

Co-Founders:

- zKilian (@Fundi_Crypto): Active in Hyperliquid community, background in yield optimization

- 800.HL: Core contributor with deep Hyperliquid ecosystem involvement

Team Profile:

- Developed by early Hyperliquid users and experienced Ethereum builders

- Self-funded initiative showing genuine commitment

- Strong partnerships with P2P.org, Hypio, and major DeFi protocols

Team Transparency Score: 6/10

While the team maintains some anonymity (common in DeFi), their track record within the Hyperliquid ecosystem and institutional backing provide credibility.

Hyperbeat Sentiment Analysis & Project Score

Overall Hyperbeat Sentiment Score: 8.4/10 (Bullish)

Breakdown:

- Funding Strength: 9/10 (Oversubscribed tier-1 round)

- Technology: 8/10 (Comprehensive DeFi suite)

- Community: 8/10 (Active Hearts program)

- Market Position: 9/10 (First-mover in growing ecosystem)

- Team Credibility: 8/10 (Strong backing despite limited transparency)

Community Sentiment for Hyperbeat: 76.3% Bullish vs 23.7% Bearish (based on 3,080 votes)

Hyperbeat Airdrop Eligibility Requirements

✅ Confirmed Requirements

- Active Participation: Engage with Hyperbeat products and earn Hearts points. Join Hyperbeat here. If you already logged in in Hyperbeat, click on Referral on top right and add the code ‘64DF4363‘.

- Minimum Activity: While no official minimum is set, aim for consistent engagement

- Valid Wallet: Compatible Web3 wallet (MetaMask, Coinbase Wallet, etc.). No wallet, no worries, you can use this guide on how to create a Metamask Wallet.

- Geographic Eligibility: No explicit restrictions mentioned, but typical DeFi limitations may apply

Hyperbeat Hearts Points Tiers

The Hearts program ranks users into tiers based on total points:

- Bronze: 0% – 24.99%

- Silver: 25% – 49.99%

- Gold: 50% – 74.99%

- Platinum: 75% – 94.99%

- Diamond: 95% – 98.99%

- Challenger: 99% – 100%

Target: Aim for Gold tier or higher for optimal potential rewards.

Step-by-Step Guide to Join the Hyperbeat Airdrop

Step 1: Set Up Your Wallet

- Download MetaMask or Coinbase Wallet.

- Add Hyperliquid network to your wallet

- Ensure you have some ETH for gas fees. You can buy ETH from Binance with Debit/Credit cards

Step 2: Connect to Hyperbeat

- Visit app.hyperbeat.org/vaults

- Connect your Web3 wallet

- Sign with your wallet and deposit HYPE or WHYPE token that you can buy from any of these exchanges

Step 3: Start Earning Heart points in Hyperbeat

Method A: Vault Deposits in Hyperbeat steps

- Navigate to “Earn” tab

- Choose from available vaults:

- HYPE Vault: Stake native HYPE tokens

- UBTC Vault: Bitcoin exposure with yield

- USDT Vault: Stablecoin yield farming

- Deposit your chosen assets

- Track Hearts accumulation in real-time

Method B: beHYPE Liquid Staking

- Access the beHYPE pre-deposit vault

- Deposit HYPE tokens before August 31st deadline

- Earn 10,000,000 Hearts + ETHFI points

- Benefit from liquid staking while maintaining yield

Method C: Morphobeat Lending in Hyperbeat

- Open “Morphobeat” tab

- Lend assets like cmETH, USDe, UETH

- Earn additional Hearts while generating lending yields

Step 4: Maximize Your Points

- Use Referrals: Earn 10% of friends’ Hearts through referral links

- Hyperbeat Leverage Spectra: Deposit in Spectra vaults for up to 41x leverage on Hearts earning

- Multi-Product Strategy: Engage across all Hyperbeat products for diversified points

Step 5: Monitor and Optimize

- Click “Hearts” button (top-right) to track points

- Aim for higher tier percentile ranking

- Stay active with weekly points distribution

- Join official Telegram/Discord for updates

Why Join the Hyperbeat Airdrop?

🚀 Strong Investment Case

Market Opportunity:

- Hyperliquid ecosystem has $2.1+ billion TVL and growing

- Hyperbeat is the first major yield infrastructure on this chain

- First-mover advantage in a rapidly expanding ecosystem

Financial Projections:

Based on similar DeFi airdrops and the $5.2M funding:

- Estimated token allocation: 15-25% for community (industry standard)

- Potential value: $0.78M – $1.3M in tokens for airdrop

- Individual rewards: $50-500+ depending on engagement level

📈 Risk-Reward Analysis

Opportunities:

✅ Tier-1 institutional backing

✅ Growing Hyperliquid ecosystem

✅ Comprehensive product suite

✅ Active development and partnerships

✅ Clear utility and revenue generation

Risks:

⚠️ Airdrop not officially confirmed

⚠️ Early-stage protocol

⚠️ Dependent on Hyperliquid success

⚠️ DeFi market volatility

⚠️ Potential smart contract risks

Risk-Reward Ratio: 1:1 (Balanced)

Additional Important Details

Timeline Expectations for Hyperbeat Airdrop

- Hearts Program: Ongoing with weekly distributions

- beHYPE Pre-deposit: Ends August 31, 2025

- Potential Airdrop: Expected Q4 2025 – Q1 2026 (speculative)

Investment Requirements

- Minimum: ~$100-500 to meaningfully participate

- Optimal: $2,000+ for significant Hearts accumulation

- Gas Costs: $5-20 per transaction on HyperEVM

Security Considerations

- Use hardware wallets for large amounts

- Verify all contract addresses on official documentation

- Start small to test the platform

- Never share private keys or seed phrases

Community Resources

- Website: hyperbeat.org

- Twitter: @hyperbeat (follow for updates)

- Telegram: Official channel for announcements

- Documentation: Comprehensive guides available

Final Verdict

Hyperbeat represents one of 2025’s most compelling airdrop opportunities. With strong institutional backing, a comprehensive product ecosystem, and first-mover advantage in the rapidly growing Hyperliquid ecosystem, the project shows significant promise.

Recommendation: PARTICIPATE – The combination of tier-1 investors, innovative DeFi products, and clear utility makes this worth the investment of time and capital for crypto enthusiasts looking to diversify their airdrop portfolio.

Remember: This is not financial advice. Always DYOR (Do Your Own Research) and never invest more than you can afford to lose in experimental DeFi protocols.